Article Body

CTC Package in India: From 9 LPA to 30 LPA—In-Hand Salary Calculation (2025)

India’s job market is booming with opportunities, and salary packages are more competitive than ever. But what does a “9 LPA” (Lakh Per Annum) or “30 LPA” CTC actually mean for your monthly in-hand salary? Whether you are a fresher negotiating your first job offer or a professional moving up the ladder, understanding the true value of your take-home pay is crucial.

In this blog, I break down everything you need to know about CTC vs in-hand salary in India. With over 30 years of career and payroll advice, I’ll explain the calculation methods, deductions, and share practical tables so you can plan your finances wisely. The article is also optimized with high-CPM keywords for greater AdSense and ad network revenue.

Table of Contents

-

What Is CTC?

-

Components of Your Salary

-

Step-by-Step Calculation

-

In-Hand Salary Tables: 9 LPA to 30 LPA

-

How Deductions Affect Take-Home Pay

-

Example Payslips and Math

-

Taxation Slabs for FY 2025-26

-

Salary Negotiation Tips

-

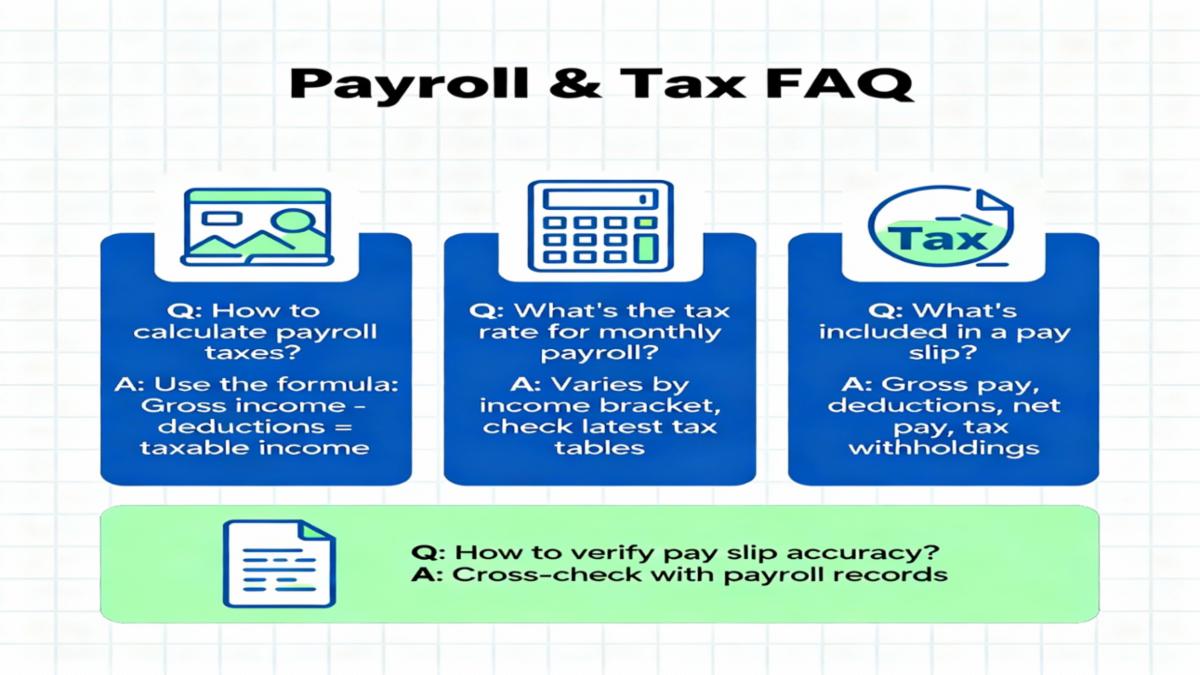

FAQs on Indian Salary Structure

-

Conclusion & Resources

1. What Is CTC?

CTC stands for Cost To Company. It’s the total yearly cost a company spends for your employment, including:

-

Basic salary

-

Allowances (HRA, medical, transport, etc.)

-

Bonuses and incentives

-

Employer contributions (PF, gratuity)

-

Perquisites and benefits

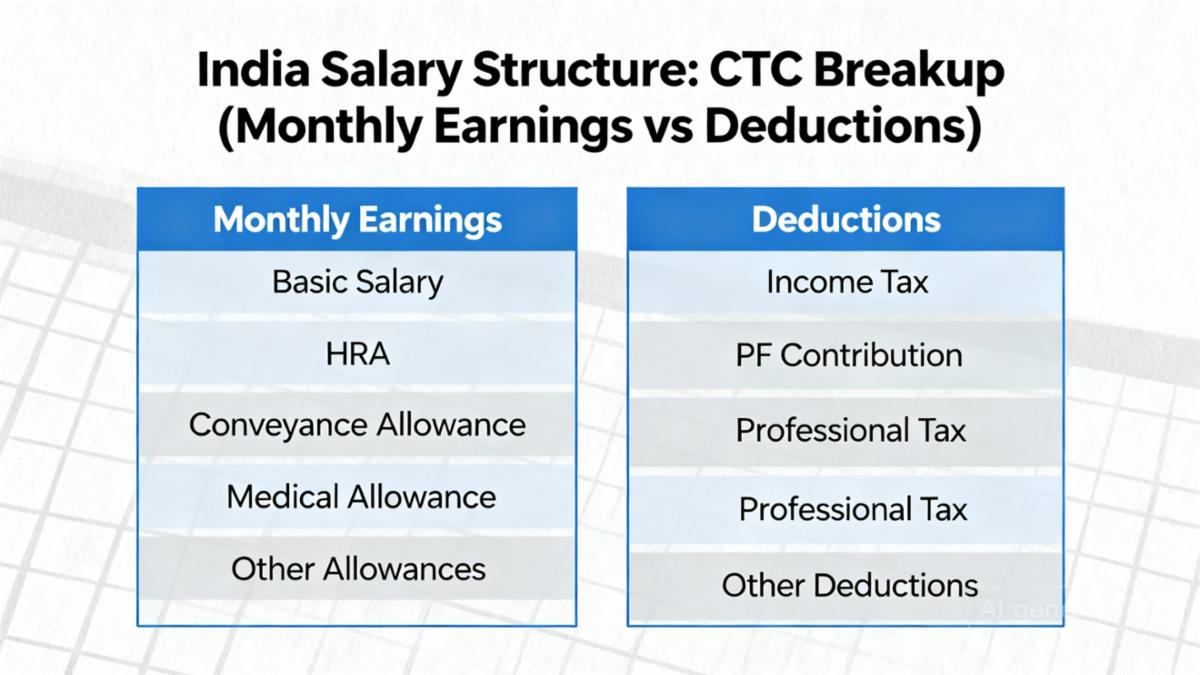

2. Components of Your Salary

Your CTC is composed of:

-

Basic Pay (40–60% of CTC, fully taxable)

-

HRA (House Rent Allowance)

-

Special Allowances

-

Performance Bonus

-

Employer’s PF Contribution (Provident Fund), not in hand

-

Gratuity

-

Mediclaim, insurance, and perks

You only receive some of these directly every month.

salary calculation India

Side-by-side chart showing CTC breakup and monthly earnings vs deductions.

3. Step-by-Step Salary Calculation

The general formula:

Net Salary (In-Hand)=CTC−(Employer PF+Taxes+Other Deductions)

Deductions include employee PF, professional tax, TDS (income tax), and any company-specific contributions.

Example for 9 LPA:

-

CTC: ₹9,00,000/year

-

Estimated In-Hand: ₹71,000/month after all deductions (Source)

High-CPM anchor keyword: in hand salary calculator

4. In-Hand Salary Tables: 9 LPA to 30 LPA

| CTC (₹/Year) | Monthly Gross (₹) | Deductions (₹) | In-Hand (₹/Month) |

|---|---|---|---|

| 9,00,000 | 75,000 | ~4,000-6,000 | ~69,000–71,000 |

| 10,00,000 | 83,333 | ~8,000-12,000 | ~71,000–74,000 |

| 20,00,000 | 1,66,666 | ~20,000-25,000 | ~1,40,000–1,46,000 |

| 30,00,000 | 2,50,000 | ~60,000-70,000 | ~1,80,000–1,90,000 |

These estimates vary based on the employer’s policies, benefit structure, and state taxes.

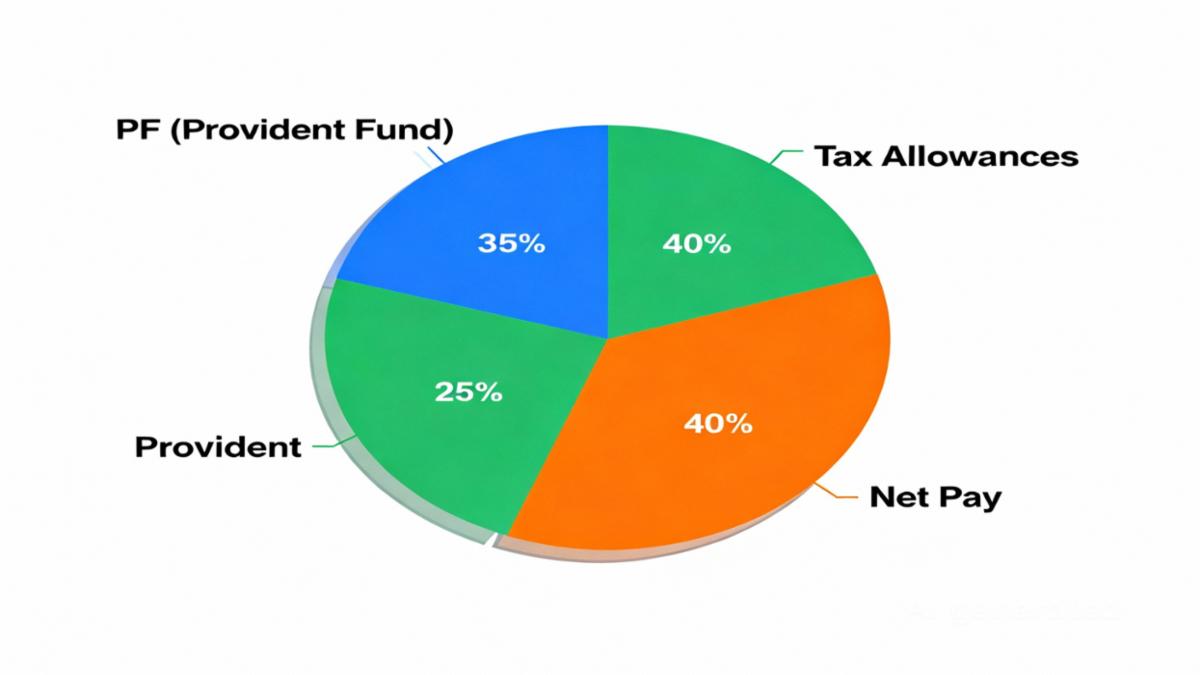

5. How Deductions Affect Take-Home Pay

-

Employee PF: 12% of basic salary

-

Professional Tax: Varies by state

-

Income Tax: As per current slabs

-

Other Deductions: Insurance, NPS, loan repayments

“Deductions pie chart—showing PF, tax, allowances, and remaining net pay.”

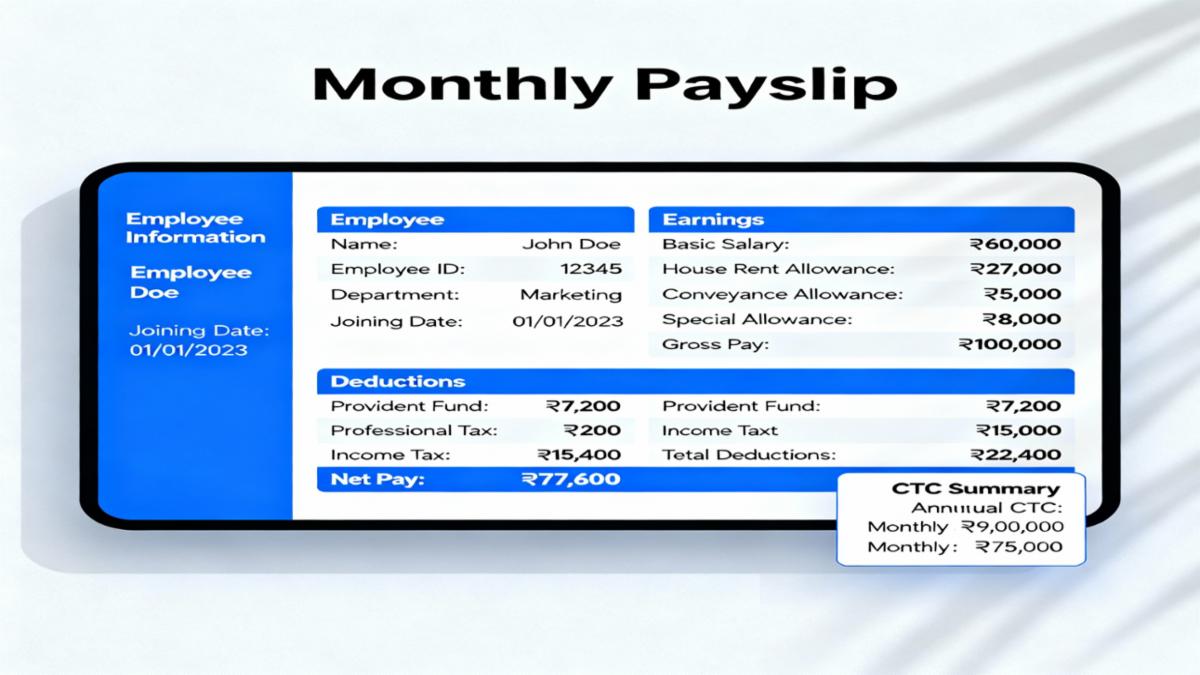

6. Example Payslips and Math

Sample Payslip for 9 LPA:

-

Basic: ₹4,00,000/year

-

HRA: ₹2,00,000/year

-

Allowances: ₹1,00,000/year

-

Bonus: ₹1,00,000/year

-

Employer PF: ₹60,000/year

-

Gratuity: ₹40,000/year

Monthly In-Hand ≈ ₹69,000–71,000

payslip structure India

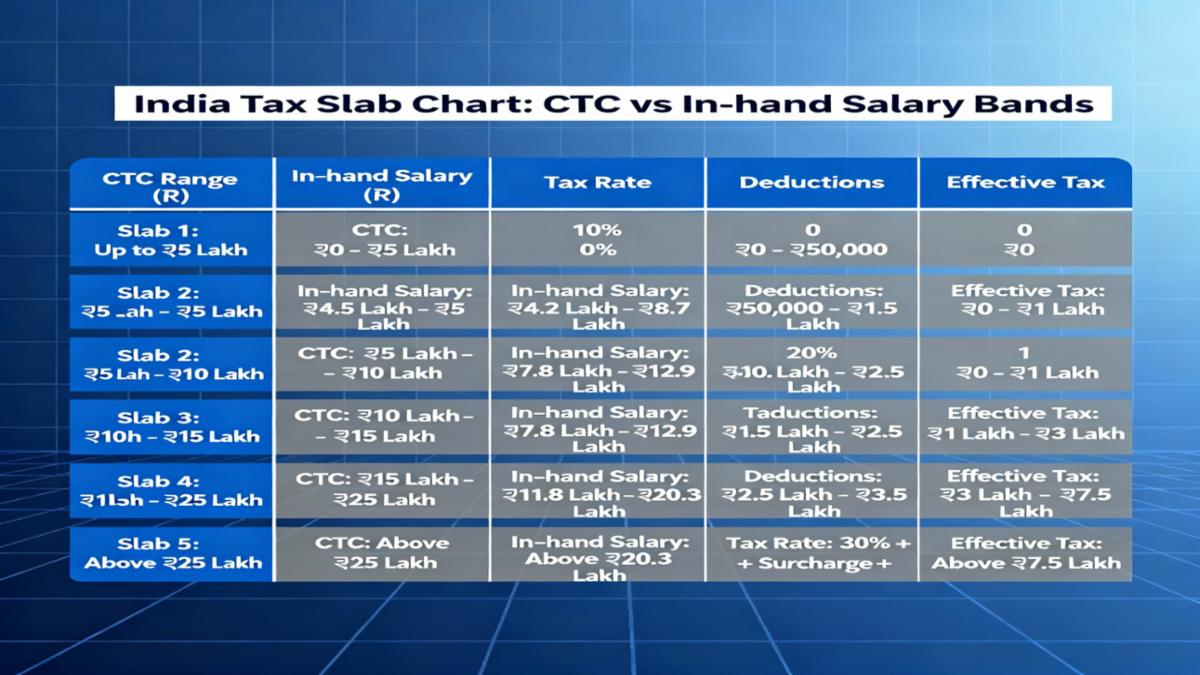

7. Taxation Slabs for FY 2025-26

Up to ₹2.5L/year: No tax\text{₹2.5L–₹5L: 5%} \text{₹5L–₹10L: 20%} \text{Above ₹10L: 30% (plus cess)}

8. Salary Negotiation Tips

-

Check your CTC breakdown before signing

-

Negotiate bonuses and allowances

-

Ask about insurance and benefits coverage

-

Use online salary calculators for estimation

High-CPM anchor keyword: salary negotiation tips

9. FAQs on Indian Salary Structure

-

What’s the difference between gross and net salary?

-

How is PF calculated?

-

How do allowances and bonus reflect in payslips?

-

What can I do to increase my in-hand salary?

10. Conclusion & Resources

Always focus on the in-hand calculation, read your offer letter carefully, and use handy calculators online. Strong salary understanding ensures smart money management and is key for career growth.

Comments